Digital transformation with legacy systems simplified

Intelligent insurance means improving operations, enabling revenue growth, and creating engaging experiences—which is the result of digital transformation. The cloud has arrived with an array of technical capabilities that can equip an existing business to move into the future. However insurance carriers face a harder road to transform business processes and IT infrastructures. Traditional policy and claim management solutions lack both cloud-era agility, and the modularity required to react quickly to market forces. And legacy systems cannot be decommissioned unless new systems are fully operational and tested, meaning some overlap between old and new.

The Azure platform offers a wealth of services for partners to enhance, extend, and build industry solutions. Here we describe how one Microsoft partner uses Azure to solve a unique problem.

The need for efficient automation

The prevailing approach to upgrading enterprise software is to engage in large scale IT projects that may take years and significant cost to execute. Delaying may only increase the costs, especially with the burden of continuing (and increasing) compliance. But more importantly, delay results in a significant opportunity cost. Due to competition, insurers are under pressure to pursue lower costs overall, and especially in claim handling. New insurance technology also forces the need for new distribution models and to automate internal workflows and supply chains.

A platform built for transformation

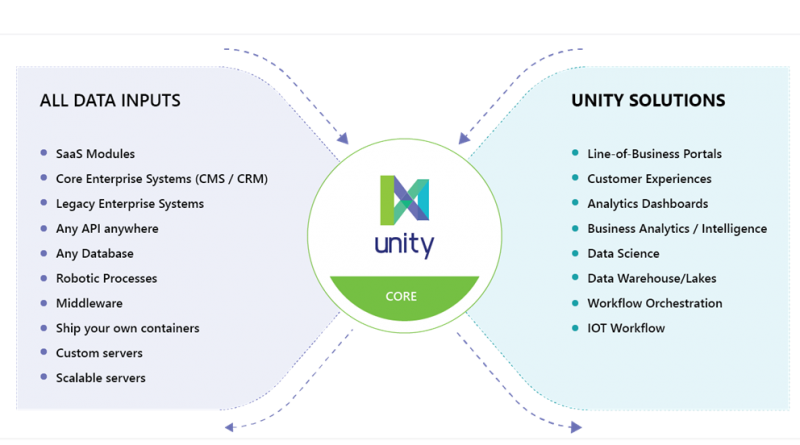

The name of Codafication’s solution is Unity (not to be confused with the Unity game engine platform). Codafication calls Unity an ecosystem Platform-as-a-Service (ePaaS). It enables insurance carriers to accelerate their digital transformation through secure, bi-directional data integration with core and legacy systems. At the same time, the platform enables Codafication’s subscribers to use new cloud-native apps and services. The increase in connectivity means customers, staff and supply chains can integrate more easily and with greater efficiencies.

Unity seeks to address the changing expectations of insured customers without disruption to core policy and claim management functions within the enterprise. Codafication stresses a modular approach to implementing Unity. Their website provides a catalog of components such as project management, supply chain and resource planning, and financial control (and more).

In this graphic, potential inputs for the system include a wide variety of processes, from legacy core systems (expected) to robotic processes (a surprise). The output is equally versatile—dashboards and portals along with data lake and IoT workflow apps.

Insurers can take an iterative and modular approach to solving high value challenges rapidly. Unity provides all the tools required to accelerate digital transformation. Other noteworthy features include:

- Custom extensions: use any programming language supported by Docker, in combination with Unity SDKs, to build custom frontend and backend solutions.

- Off-the-shelf apps: plug in applications and services (from Codafication) designed for the insurance industry.

- Scalability: cloud-native technology, underpinned by Kubernetes, can be hosted in the cloud or in a multi-cloud scenario, with a mix of Docker, serverless and on-premises options.

- GraphQL API: leverage the power of a graph database to unlock data silos and find relationships between data stores from legacy systems. Integrate with cloud vendors, AI services and best-in-breed services through a single, secure, scalable and dynamic API.

- Integrative technologies: create powerful custom IoT workflows with logic hooks, web hooks and real-time data subscriptions.

Benefits

- Through Unity, organizations can interconnect everything and relate data on the fly. Developers can leverage legacy core systems, middleware, and robotics using a microservice architecture driven by a powerful service mesh and extensible framework.

- Teams can leverage this infrastructure to deliver (in parallel) solutions into the platform and into the hands of their users. Insurance carriers will find new use cases (like data science uses, and AI) and develop apps rapidly, to deliver projects faster, for less cost and less risk.

- Projects can be secured and reused across the infrastructure. This accelerates digital transformation projects without disrupting existing architecture and is the primary step to implementing modern cloud native technologies, such as AI and IoT.

- The ‘modernize now, decommission later’ approach to core legacy systems lets an insurer compete and remain relevant against competitors while providing a longer runway for decommissioning aging legacy systems.

Azure services

Unity leverages the power of Microsoft Azure to provide secure private cloud capability across the globe including services such as:

- Azure Kubernetes Service

- Azure Application Insights

- Azure Monitor

- Azure Security Center

- Azure Blob Storage

- Azure Database for PostgreSQL

Next steps

To learn more about other industry solutions, go to the Azure for insurance page.

To find out more about this solution, go to Unity Cloud and click Contact me.

Source: Azure Blog Feed